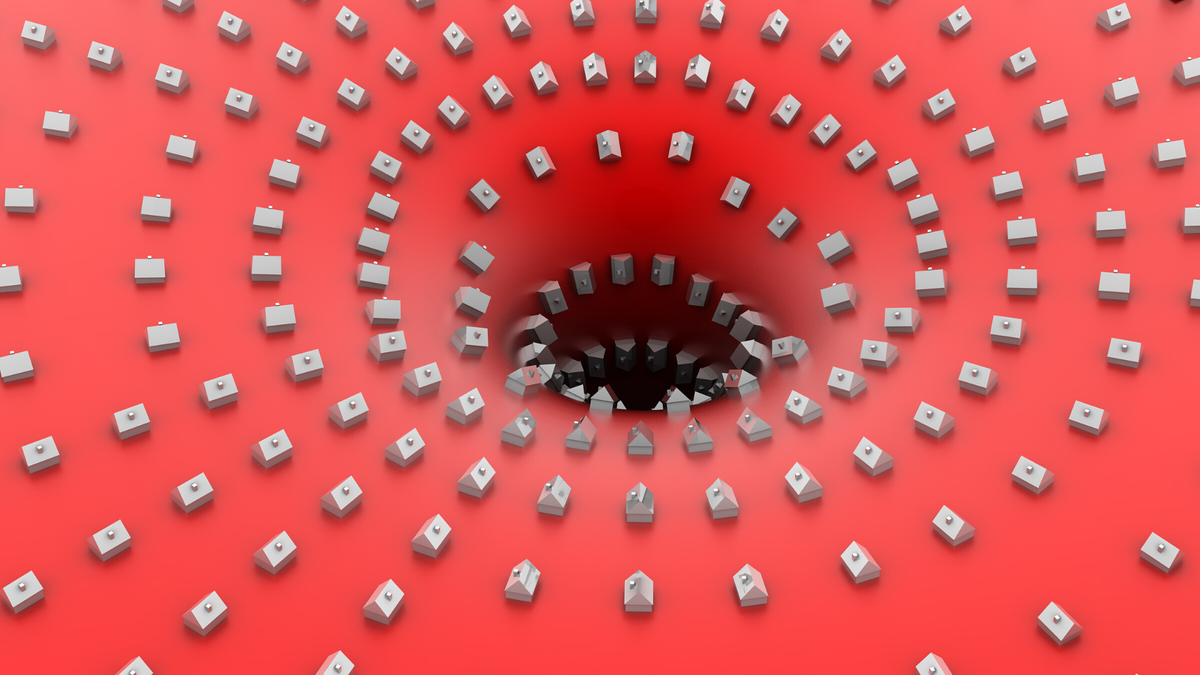

Is the Housing Market About to Crash? Here’s What Experts Say

The housing market, a crucial part of any economy, has always been a subject of interest for economists, investors, and everyday citizens alike. With its ebbs and flows, rises and falls, it is a constant source of speculation and anxiety. The housing market is not just about bricks and mortar; it's about people's lives, their financial security, and their future.

The housing market is a complex entity. It comprises various elements such as supply and demand, affordability, interest rates, and economic conditions. It's an integral component of the broader economy, with its performance affecting numerous other sectors. The health of the housing market can often reflect the overall economic health of a country.

The housing market has a significant impact on individuals' financial health. For many people, their home is their largest asset. Therefore, changes in the housing market can have a profound effect on their wealth. However, like any market, the housing market is vulnerable to crashes, which can lead to devastating effects.

What triggers a housing market crash?

A housing market crash isn't a spontaneous event; it's triggered by a combination of factors. These may include a surge in housing prices, economic instability, unemployment, and changes in government policy. Understanding these triggers is crucial to predicting and potentially mitigating a crash.

A surge in housing prices, often fueled by speculation, can lead to a housing bubble. When prices reach unsustainable levels, the bubble bursts, leading to a sharp decrease in house prices. This was the case in the 2007-2008 financial crisis, where inflated housing prices led to a catastrophic crash.

Economic instability and unemployment can also trigger a housing market crash. If people are uncertain about their financial future or lose their jobs, they are less likely to invest in property. This can lead to a drop in demand, causing house prices to fall. Changes in government policy, such as changes in interest rates or lending criteria, can also impact the housing market.

The role of the banking system in the housing market

Banks play a pivotal role in the housing market through their lending practices. They provide the mortgages that enable people to buy homes. This makes them a crucial player in the housing market, influencing its health and stability.

Banks' lending practices can significantly impact the housing market. For example, if banks loosen their lending criteria, more people can access mortgages, potentially leading to a rise in house prices. Conversely, if banks tighten their lending criteria, fewer people can obtain mortgages, possibly causing a drop in house prices.

The banking system's stability is also crucial to the housing market. If the banking system is unstable, it can lead to a lack of confidence in the market, causing people to delay buying homes. This can lead to a decrease in demand and a potential drop in house prices.

Understanding the bank collapse housing market theory

The bank collapse housing market theory suggests that a severe banking crisis can lead to a housing market crash. This theory was evidenced during the 2007-2008 financial crisis, where reckless lending practices led to a banking crisis, which subsequently triggered a housing market crash.

The theory operates on the principle that banks, through their lending practices, significantly influence the housing market. If banks engage in reckless lending, providing mortgages to those who cannot afford them, it can lead to a surge in house prices as more people are able to buy homes.

However, when these borrowers cannot repay their loans, it leads to a rise in defaults. This can trigger a banking crisis, as banks struggle to recoup their losses. As the banking crisis deepens, confidence in the housing market wanes, leading to a drop in demand and a subsequent housing market crash.

Signs of a potential housing market crash

Recognizing the signs of a potential housing market crash is crucial for mitigating its effects. These signs can include a surge in housing prices, an increase in mortgage defaults, economic instability, and changes in government policy.

A surge in housing prices can indicate a housing bubble. If prices are rising at an unsustainable rate, it could be a sign that a crash is imminent. Similarly, an increase in mortgage defaults can be a red flag. This can indicate that people are struggling to meet their mortgage repayments, potentially signaling a future crash.

Economic instability can also be a sign of a potential housing market crash. If the economy is performing poorly, people may be hesitant to invest in property, potentially leading to a drop in house prices. Changes in government policy, such as changes in interest rates or lending criteria, can also signal a potential crash.

What experts say about the current housing market status

Experts' views on the current housing market status vary, with some predicting a crash while others expect a slowdown. However, most agree that the housing market is currently experiencing a period of high prices, fueled by low-interest rates and a lack of supply.

Some experts believe that these high prices are unsustainable and predict a housing market crash. They point to the increasing number of mortgage defaults and the economic instability caused by the COVID-19 pandemic as indicators of a potential crash.

However, other experts believe that while the housing market may slow down, a full-blown crash is unlikely. They argue that government measures, such as mortgage forbearance programs and stimulus checks, have helped prevent a surge in defaults. Furthermore, they suggest that the current high prices are due to a genuine lack of supply, rather than speculative buying.

Impact of a housing market crash on the economy

A housing market crash can have a profound impact on the economy. It can lead to a decrease in consumer spending, a rise in unemployment, and a potential banking crisis.

When house prices fall, homeowners' wealth decreases. This can lead to a decrease in consumer spending as people feel less financially secure. As consumer spending decreases, businesses may struggle, leading to layoffs and an increase in unemployment.

A housing market crash can also lead to a banking crisis. If house prices fall, homeowners may default on their mortgages, leading banks to incur significant losses. This can destabilize the banking system, potentially leading to a wider economic crisis.

How to prepare for a potential housing market crash

Preparing for a potential housing market crash involves taking steps to safeguard your financial health. This can include diversifying your investment portfolio, maintaining a robust emergency fund, and being cautious about taking on large amounts of debt.

Diversifying your investment portfolio can help protect your wealth in the event of a housing market crash. Instead of relying solely on property, consider investing in other assets such as stocks, bonds, or mutual funds. This can help mitigate the impact of a housing market crash on your overall wealth.

Maintaining a robust emergency fund is also crucial. This can provide a financial buffer in the event of a crash, helping you meet your mortgage repayments and other expenses. Being cautious about taking on large amounts of debt can also help. If you have significant debt, you may struggle to meet your repayments if your income decreases or if interest rates rise.

Predictions for the future of the housing market

Predicting the future of the housing market is challenging, given its complexity and the numerous factors influencing it. However, most experts agree that the housing market will likely experience some changes in the coming years.

Many predict that house prices will eventually slow down, given their current high levels. Some believe that this slowdown could lead to a crash, while others expect a more gradual decrease in prices. The extent of this slowdown or crash will likely depend on various factors, including economic conditions, government policies, and the stability of the banking system.

Some experts also predict that the housing market will become more segmented in the future. They suggest that demand for certain types of property, such as suburban homes, may increase, while demand for others, such as city apartments, may decrease. This could lead to significant variations in house prices across different areas and property types.

Conclusion

While the prospect of a housing market crash can be worrying, understanding the factors that can trigger such a crash and recognizing the signs can help prepare for such an event. While experts' opinions on the current housing market status and future predictions vary, it's clear that the housing market, like any market, is subject to fluctuations.

The housing market's future will likely be influenced by numerous factors, including economic conditions, government policies, and the stability of the banking system. By staying informed about these factors and taking steps to safeguard your financial health, you can navigate the complexities of the housing market with confidence.

Do you have unpaid credit cards?

Gauss money can help pay off your credit cards easily. Pay off any credit card balance using a low-interest credit line from Gauss. You’ll save with a lower APR and you can pay off balances faster. Gauss offers no annual fees, no origination fees, and no fees of any kind. Check out Gauss for a lower APR today to maximize your credit cards.

Additionally, use tools like the credit card payoff calculator to visualize your progress overtime, and get insights into how much you should put towards your debt to achieve your debt free date. Our debt payoff calculator and debt tracker is 100% free to use via our website or our mobile app.